As per 1-1-2021 new rules apply for trade with the UK. I came across this issue at one of our customers. In this article I describe the impact of these changes on Business Central.

This article is typically meant for readers in the EU and is simplified.

First we describe the changes due to Brexit, then we describe how this affects Business Central and the last part consists of tips to implement these changes in the software.

changes due to Brexit

The EU is a single market and has simplified the VAT handling for intra-EU trade in where the buyer takes over the VAT obligation from the supplier. This implicates that the supplier does not charge VAT. Instead the buyer, who takes over the VAT obligation, will need to register the VAT as input as well as output.

This means that for:

- Delivery of goods and services 0% VAT applies.

- Receipt of goods and services reversed charge VAT applies.

In a simple scenario there are some conditions that need to be met to apply these rules. (1) The buyer is a VAT registered party, (2) the goods or services need to be business related and (3) the supplier needs to state on the invoice that Article 138 (1) of Directive 2006/112 / EC is applicable.

The VAT declaration in all EU-countries separates the amount sold in the EU, the amount and VAT amount purchased, whereas the VAT purchased is placed under VAT receivable as wel as payable. Additionally a listing is required to list all sales per VAT-number split in goods and services.

If these requirements are not met then trade must be seen as distance selling. If it stays below a buyer’s country thresholds, then the VAT of supplier’s country can be applied. Otherwise VAT of buyer’s country is applicable.

Now with Brexit per 1-1-2021 outside EU rules apply for the UK. This means:

- Delivery of goods and services are subject 0% VAT.

- Receipt of services are subject to reversed charge VAT

- Receipt of goods are also subject of reversed charged VAT, either the VAT payable is claimed at customs, or it can be reported at VAT submission. The latter is possible when there is an agreement with tax authorities. By the way: in the UK this rule automatically falls under the name Postponed Accounting.

Northern Ireland (NI) has a different status: Goods are treated as EU-trade. Services are treated as NON-EU. Trade of goods between NI and GB is considered as UK domestic trade. However trade between EU and GB through NI requires export from GB to NI and from NI EU-trade. Look like a chameleon to me.

Trade with the UK requires a so called EORI (Economic Operator Registration and Identification number). It is advisable to agree on incoterms with the business partner.

Of course there are exceptions and scenario’s where these rules apply differently (MOSS, ABC, etc). I might come to this in a next article.

consequences for Business Central administration

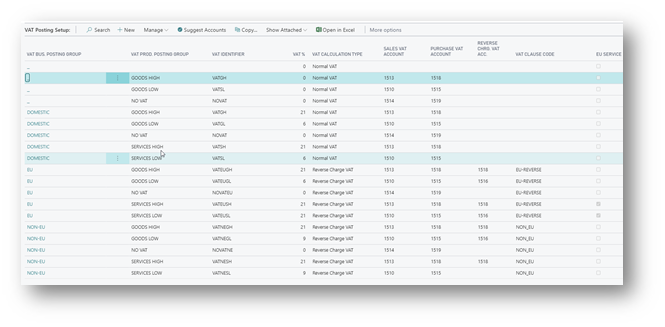

Before the Brexit trade of goods and services with the UK was subject to revered charge VAT. According to an example of VAT Business Posting Setup in the picture below a UK customer or vendor was connected to VAT Business Posting Group EU. Please keep in mind that this setup is just an example and can deviate from yours.

After the Brexit NI should be treated differently from GB (England, Wales and Scotland).

Customer or vendor of GB should be connected to VAT Business Posting Group NON-EU, while NI should formally have two VAT Business Posting Groups; one for the goods (EU), and one for services where non-EU rules apply.

If you deal with NI for only goods or services then it the choice is easy. But if it is both, then you have a promiscuous situation. One time EU and another time NON-EU. Let alone when it services and goods are on one document.

A solution for this could be to create a special VAT Product Posting Group for that good or service. That is how you can distinct one from another.

implementation

Although we are already plunged into the new year you still might want to change the administration setup to accommodate the new situation.

The simplest way of doing this would be:

- Change VAT Posting Groups of GB and possibly NI customers and vendors to NON-EU. With big numbers Rapid Start functionality would be a great help.

- Create a new Vat Product Posting Group and corresponding product (item, resource, etc.) in case needed for NI scenario (see above).

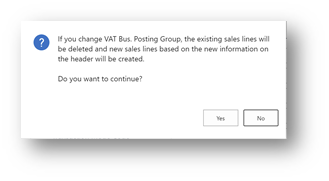

- Change VAT Business Posting groups for those documents that contain UK customers or vendors. Doing this will change the lines accordingly for the renewed VAT combination. Documents of which goods already have been posted cannot be changed, even if you partial delivery/receipt. To some extend this makes sense, since VAT follows the goods.

- For NI changes: apply these to the documents.

Of course if you have lots of changes, you might want to call your technical consultant to automate some of these steps.

sources

- Local tax authorities websites

- EC website